Introduction

Our team is deeply involved in the memecoin market and are firm believers in the memecoin supercycle.

The International Meme Fund (IMF) began as a humorous idea among friends at the ETHGlobal Sydney Hackathon.

It has since evolved into a full-fledged DeFi credit application with a native unstablecoin, with a purpose of allowing our (actually very technically competent) team to experiment with several new primitives we have developed.

Opportunity

Memes have achieved escape velocity in the crypto industry, forming their own market with dedicated participants. Some memes have grown into multi-billion dollar valuations and ecosystems.

We believe it is now crucial to have native liquidity and financial infrastructure for the meme sector.

The problem we address is this: Our degen brothers and sisters no longer have to choose between MEMES and DREAMS. If you have a sizeable investment in your favourite memecoin and don't want to sell because you expect it to moon, but you also need to buy a Lambo, like right now, to impress that girl on twitter you've been messaging for the past 3 months, you can now do both. Degens can finally hold that seven-figure memecoin investment and drive off into the sunset with your new lambo and e-girl.

What is IMF?

IMF is a DeFi protocol that allows users to deposit their blue-chip memes and borrow our native meme-backed unstablecoin, $MONEY.

IMF provides liquidity pools (LPs) for trading memes against $MONEY.

The protocol's native equity and utility token is $IMF, which is used to accrue and distribute protocol revenue. Protocol revenue comes from interest paid by borrowers of $MONEY. In addition to borrowing, users can provide liquidity by pairing their memes with $MONEY (e.g., PEPE/MONEY LP) and earn trading fees + $IMF emissions.

IMF Mechanics Overview

Core mechanics

We might add some actual technical explanations of how our contracts work here later on if the market wants it, but for now we will just cover the overall flow of the protocol

There are a few components to the IMF protocol that work together to create an autonomous business structure with incentives and revenue for all users

The core flow of the protocol is:

- User deposits meme collateral and borrows $MONEY.

- User then can use $MONEY for:

- a. Sell $MONEY for anything they wish like a new lambo

- b. Sell $MONEY on secondary markets for more memes or other crypto

- c. LP $MONEY with their meme collateral of choice in our pools

- Borrowers and LPs get $IMF emissions and can:

- a. Play the IMF slow burn game, to receive protocol revenue.

- b. Sell it for more memes or lambos

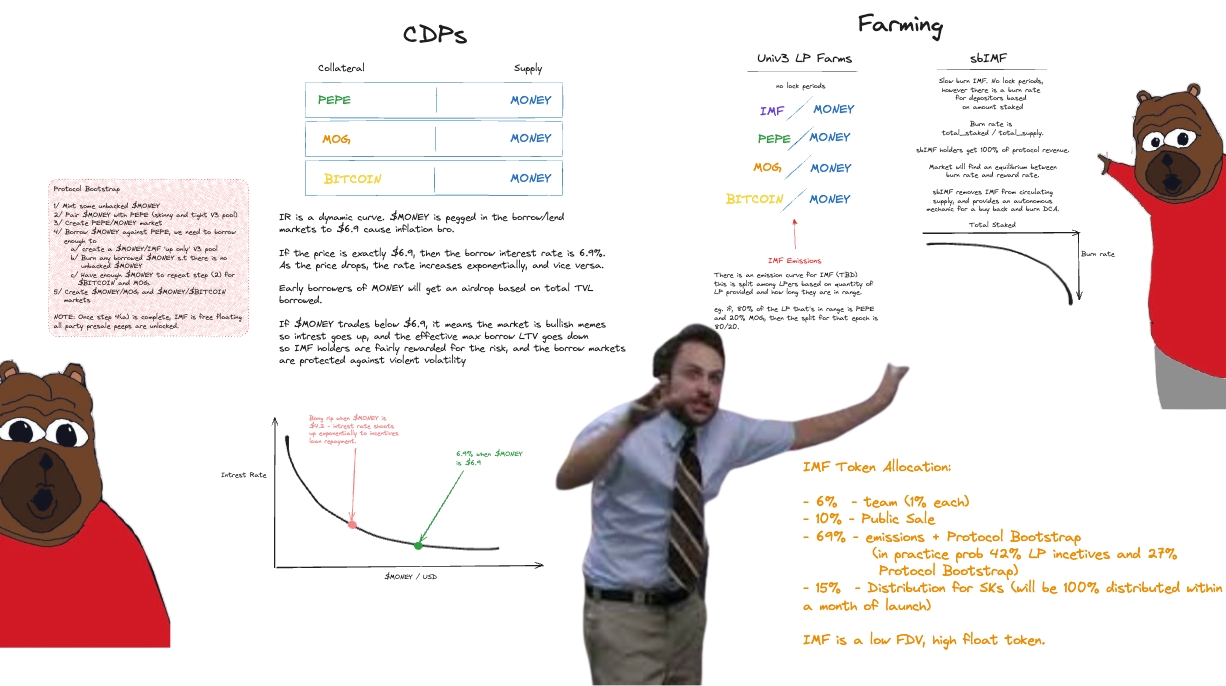

CDPs

At launch, the IMF will accept the following collateral options to borrow $MONEY:

- PEPE

- MOG (coming soon after launch)

Currently, the maximum you can borrow against all collateral is 69% LTV (Loan-to-Value). When you deposit your meme collateral and borrow $MONEY, you will accrue interest on the debt. Interest is accrued at a variable rate based on our Interest Rate Model, detailed in the $MONEY tokenomics.

You can access your meme collateral once you repay the total debt owed on the CDP (Collateralized Debt Position).

You can manage your CDP in 4 ways:

- Add more collateral (to improve loan health and increase the borrow limit).

- Repay partial debt (to improve loan health).

- Borrow more debt (up to the max LTV).

- Withdraw collateral (up to the max LTV).

Liquidations

If the value of your collateral decreases and your LTV ratio reaches 69%, you will be liquidated, and your meme collateral will be used to repay the debt. In the event of liquidation, you will have no meme collateral to withdraw.

The LTV will always change based on the price of your underlying meme collateral, as the debt price is always pegged at $6.90 per $MONEY in the CDP.

LPs

IMF has the current Liquidity Pools:

- PEPE/MONEY

- IMF/WETH

These are completely standard Uni V3 Pools.

If you provide liquidity to any of the pools, you will receive your share of the trading fees that happen within the pools.

IMF Tokenomics

The IMF will have 2 tokens:

- The primary utility token $IMF

- The meme-backed unstablecoin $MONEY

$IMF

IMF is the native equity and utility token of the protocol

Total Supply: 34,500,000

Token Allocation:

- 20% - Public Sale

- 15% - Team

- 30% - SK Fund

- 25% - Borrower Airdrops

- 8% - sbIMF Rewards

- 2% - LP

None of the token supply is vested.

Public Sale

In the most crypto fashion, we decided to conduct a public sale to raise funds for the funding and bootsrapping of the protocol.

We sold 6,900,000 IMF tokens for 269 ETH

public sale was open from the 01/06/2024 and closed on the 12/06/2024, 3900 ethereum wallets participated.

Team

Team allocation is for core contributors, and also smaller contributors, such as Auditors and developers who helped along the way during our build phase

Each core contributor has taken a small percentage of supply, please pump $IMF so we actually get paid from this

ty

SK Fund

This portion of supply should be regarded as what would normally be “foundation” funds, the team will use this for the further development and support of the protocol.

It will predominantly be directly used to drive business development and heavily incentivize increasing $MONEY trading depth.

Foundation supply is non-vested but considered non-circulating supply.

LP

We have supplied 2% of IMF supply to the initial full range IMF/WETH pool along with the corresponding ETH and this has been burned forever.

Borrower Airdrops

To Incentivize the borrowing of $MONEY we have allocated 25% of IMF supply through 5 separate airdrops of 1,725,000 tokens each, exclusively for borrowers of $MONEY at these milestones of money supply:

- 1 month >100k $money supply

- 1 month >1M $money supply

- 1 month >5M $money supply

- 1 month >10M $money supply

- 1 month >25M $money supply

Airdrops occur after 1 month of consistent outstanding money supply larger than the target amount to avoid flash loan farmers. For further clarity, this means the first airdrop will happen after 1 month of having total outstanding money supply consistently stay above 100,000 $MONEY.

More details on the airdrops will come soon, please note, we will announce a block where participation starts counting for airdrops, which will be soon.

sbIMF: Slow Burn IMF

This is staked $IMF with no lock periods, however there is a burn rate for depositors based on amount staked, effectively a negative interest rate. This means you will slowly lose your balance of sbIMF as time goes on

So why TF would you do this?....

sbIMF holders recieve a claim on 100% of protocol revenue.

Protocol revenue is all interest paid on the $MONEY debt issued to users.

Burn rate = total_staked / total_supply.

Market will find an equilibrium between burn rate and reward rate.

sbIMF removes $IMF from circulating supply, and provides an autonomous mechanic for a buy back and burn DCA.

At launch, there is no UX for sbIMF, however the contracts are deployed, we will launch the UX and update these docs with more information shortly after MVP.

Lastly, we will incentivize committing your IMF tokens by streaming IMF rewards to this pool. 8% of supply will be streamed to this pool.

The Details on if there is a lock or the emissions/airdrop schedule for the 8% to sbIMF holders will be clarified here shortly.

$MONEY

$MONEY is the native “unstablecoin” of the IMF.

$MONEY gets minted when a user borrows against deposited collateral

$MONEY is a fully decentralized permissionless softpegged stablecoin backed by memes

Total Supply: dynamic supply based on how much is borrowed + interest accrued

SoftPeg Mechanisms:

$MONEY targets a price of $6.90… because of inflation bro.. through 2 main softpeg mechanisms

- Interest Rate Model

- CDP Pricing Model

Interest Rate Model

$MONEY interest rate is a dynamic curve.

If the price is exactly $6.90, then the borrow interest rate is 6.9%, this is the "kink" in the curve.

As the price of $MONEY depegs down form $6.90, the interest rate increases exponentially. If the price of $MONEY depegs above $6.90, the interest rate decreases.

If $MONEY trades below $6.90, it means the market is bullish memes so interest rate goes up to increase the cost of borrowing and incentivize repaying debts. If $MONEY trades above $6.90, the interest rate goes down to decrease the cost of borrowing and incentivize taking debt.

CDP Pricing Model

$MONEY is hard pegged at $6.90 in the CDP markets.

This means that when a user deposits a meme and borrows $MONEY, they borrow it at a protocol value of $6.90, regardless of its trading price on secondary markets. Consequently, when a user wants to repay their debt, they repay it at a rate of $6.90 per $MONEY.

This creates an arbitrage that helps maintain the peg of $MONEY.

If $MONEY is trading below $6.90 on secondary markets, users are incentivized to buy $MONEY from these pools and repay their debt, as they are buying at a discount and repaying at $6.90.

Conversely, if $MONEY is trading above $6.90 on secondary markets, users are incentivized to deposit memes, borrow $MONEY at $6.90, and sell it at the higher market price.

This buy/sell pressure arbitrage helps move liquidity to keep $MONEY soft pegged at $6.90.

Genesis

To get the protocol off the ground for genesis the protocol will use the presale funds raised to bootstrap the liquidity pools by free minting $MONEY against DAI.

Links

- Website: https://internationalmeme.fund/

- Telegram: http://t.me/intlmemefund

- Twitter/X: https://x.com/intlmemefund

- Warpcast: https://warpcast.com/~/channel/imf

- Github: https://github.com/International-Meme-Fund

Contributors

Token Contracts

- IMF: 0x05be1d4c307c19450a6fd7ce7307ce72a3829a60

- MONEY: 0xb162caa6b63de33edc5d0a14b901fb6a54ee6b8f

- sbIMF: 0x3215c358b7a70c09e0a98827f744d107095e14e4

Contract Audits

- Hashlock: @Hashlock_

- Bug Bounty: https://www.hashlock.com.au/bug-bounty/imf